deltaDNA, a game analytics company, has released the results of a comparison between Key Performance Indexes (KPI) of over 1000 F2P games (split about evenly between Android and iOS), broken down by genre. The results are relatively predictable, but they do verify what most of us suspect regarding the kind of players each genre attracts and the effect of different types of IAPs on player retention and revenue. Apparently, Action and Strategy games have a greater initial player retention because of their more “hardcore" player base while Puzzle games retain fewer day-one players but keep them over a longer period of time. Overall, though, the differences in most categories aren’t that great.

deltaDNA, a game analytics company, has released the results of a comparison between Key Performance Indexes (KPI) of over 1000 F2P games (split about evenly between Android and iOS), broken down by genre. The results are relatively predictable, but they do verify what most of us suspect regarding the kind of players each genre attracts and the effect of different types of IAPs on player retention and revenue. Apparently, Action and Strategy games have a greater initial player retention because of their more “hardcore" player base while Puzzle games retain fewer day-one players but keep them over a longer period of time. Overall, though, the differences in most categories aren’t that great.

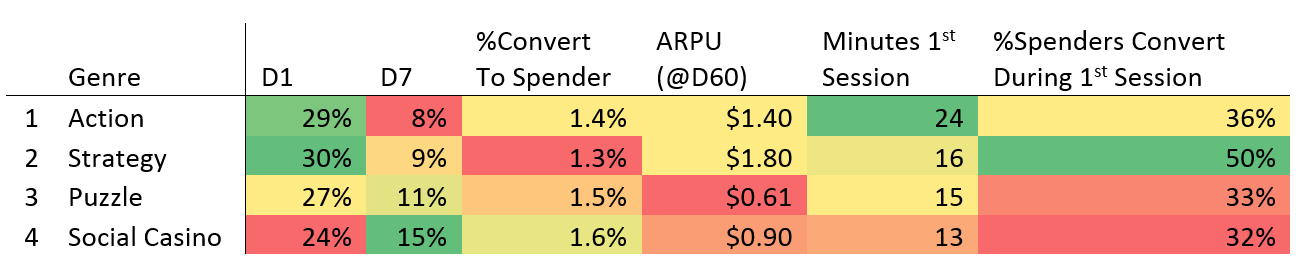

deltaDNA examined the following four genres: Action (FPS and RPG based games), Strategy (RTS, CCGs, and builder games), Puzzle (match 3, hidden object and quiz games), and Social Casino (slots, poker, etc). Now, I do have issues with deltaDNA’s categories as, for example, an FPS player and an RPG player don’t often play for the same team. Nevertheless, deltaDNA looked at Day 1 Retention (retention refers to players who return one day after install), Day 7 Retention, Percentage of Installs that Convert to Spenders, Average Revenue per Installing Player (ARPU), Average Length of the First Session, and Fraction of Spenders who Convert in the First Session.

As we can see from the results above, Action and Strategy games have the best Day 1 Retention (although not by a great margin), which makes sense when we consider that most players of those kind of games already know what the game will be like and, so, stick around after playing it the first time. By Day 7, though, Puzzle and Social Casino games have better retention rates than Strategy games, indicating that the players who do stick around in games of that genre stick around for longer than players of Strategy games and Action games, perhaps due to the designers’ conscious attempts to “hook" their players.

When it comes to money spent, strategy games convert half of their players to spenders on the first session, which again speaks to the nature of those who play strategy games and the fact that most IAPs in strategy games are extra scenarios rather than consumables. Same goes for the Revenue spent since Strategy games have fewer IAPs than Puzzle games, but they are usually on the expensive side. It makes sense, then, that the ARPU of Puzzle games in particular is so much lower than that of Strategy games over a 60 day period; in a match-3 game, for instance, people will buy cheaper IAPs over a long period of time.

As I said in the beginning, the numbers here aren’t really surprising, but they do verify what we believe about the kind of gamers the different genres attract. Strategy and Action games (broadly defined) attract the more “hardcore" players who tend to know what they are getting themselves into and will buy IAPs early on. Puzzle games developers, on the other hand, see less spending early on but can be more confident that they’ll see more players sticking around in the long run. Keeping in mind these numbers and knowing that development companies are aware of these numbers too helps us understand the various marketing strategies employed by companies and, maybe, figure out why one marketing strategy failed to turn a game into a success while another one succeeded.